With AI-powered analytics, financial firms can analyze vast datasets, enabling real-time insights and informed decision-making. Managing AI-related risks, lack of maintenance, and executive buy-in are top reported challenges in finance.

Integrating artificial intelligence (AI) and advanced analytics in tax and finance enables organizations to process vast amounts of data with unprecedented efficiency. Finance professionals, with AI-powered insights, can make informed decisions in real-time, optimize operations, and alleviate risks. However, regulatory compliance, executive buy-in, and ongoing system maintenance pose significant challenges.

In its recent Tax and Finance Operations Survey, EY reveals how accessing and operationalizing high-quality data at speed continues to be a challenge for most organizations. According to the survey, tax personnel currently spend three-quarters of their time, 75 percent, on routine compliance work. It includes data collection and cleansing, tax return compliance, and related reconciliations.

This challenge shows how crucial is to leverage modern technologies. With the integration of AI into financial operations, organizations can witness a fundamental shift in how financial data is handled, assessed, and leveraged for strategic decision-making.

AI-powered data optimization tools enable financial institutions to unlock new levels of efficiency and accuracy to gain real-time insights that were not attainable earlier.

AI and Advanced Analytics in Tax and Finance

The application of AI in tax and finance is multifaceted. It primarily emphasizes enhancing predictive analytics, data accuracy, compliance management, and operational efficiency. Using advanced algorithms and machine learning techniques, AI-driven data optimization analyzes vast datasets, enabling real-time insights and informed decision-making.

This capability is particularly critical in tax management, where the margin of error can be substantial. AI solutions can take this risk away as they can automate the intricate process of tax calculation, filing, and reporting, freeing up valuable resources for more strategic tasks.

The EY Tax and Finance Operations Survey shows tax practitioners spend just 28% of their time on higher-value work. This includes data analysis, managing tax controversy, tax planning, general strategy, communications, and risk management.

AI can provide future financial trends through which businesses can make informed decisions and optimize their tax strategies. This predictive power of AI can be a game-changer in an environment where financial agility and prediction are crucial to maintaining a competitive edge.

Applications of AI in Tax and Finance:

The applications of AI and advanced analytics in tax and finance are vast, revolutionizing the finance sector.

Automation of Routine Processes

One of the most significant impacts of AI in finance is its ability to automate routine and mundane tasks. Manual tasks like transaction processing, data entry, and invoice matching are time-consuming and prone to human error. With AI-enabled tools, these tasks can be automated while freeing up finance professionals for more strategic activities.

Predictive Analytics and Forecasting

Powered by AI, predictive analytics allows businesses and finance professionals to evaluate historical data and identify patterns to envisage future trends. This capability is particularly beneficial in financial planning and strategy development. With AI-powered predictive analytics, professionals can predict cash flow patterns, helping them anticipate potential shortfalls or surpluses and plan accordingly.

Tax Planning and Compliance

With ever-changing tax regulations, staying compliant is a significant challenge for businesses. AI and advanced analytics can streamline tax planning and compliance, minimizing the risk of errors and penalties. With AI-powered tax software, businesses can automate tax calculation and filing.

Risk Management and Fraud Detection

AI and advanced analytics can even play a crucial role in detecting and mitigating financial risks. These technologies can identify unusual transaction patterns and flag potential fraud in real-time, allowing businesses to take proactive measures. AI-driven models can examine the creditworthiness of customers by analyzing their financial history and other relevant data, lowering the risk of defaults.

As AI continues to evolve, its potential to transform tax and finance will only grow. With investment analysis, portfolio management, and providing customer insights and personalization, AI can enable businesses and finance professionals to drive efficiency across tax and financial planning.

Also Read: How Artificial Intelligence Can Power Corporate Social Learning

Challenges and Considerations

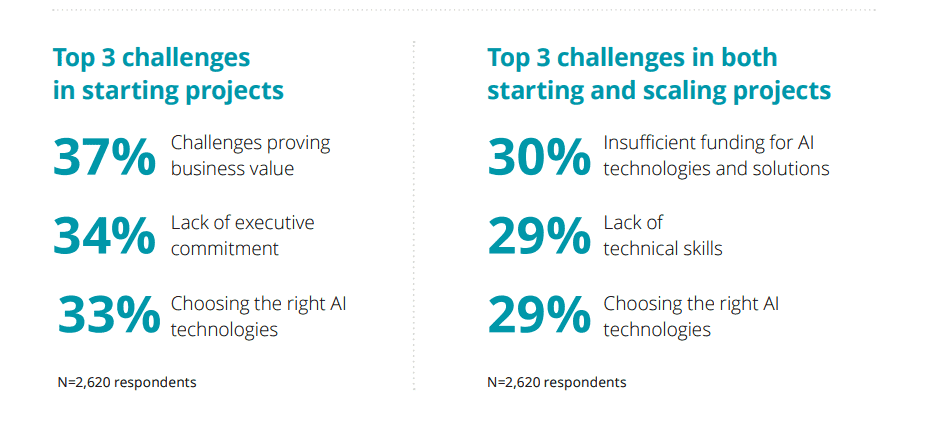

As there are various transformative benefits of AI, its adoption in tax and finance poses significant challenges. According to a survey by Deloitte, proving AI’s business value, managing AI-related risks, lack of executive buy-in, and lack of maintenance or ongoing support are the top challenges when starting new AI projects.

Here are the key challenges of implementing AI and analytics in tax and finance:

- Data privacy and security

- Ethical considerations

- Skill gaps and workforce adaptation

- Integration with legacy systems

- Cost and resource allocation

- Data quality and management

- Regulatory and compliance challenges

Addressing these challenges requires strategic leadership, discipline, and focused investment. Data encryption, algorithm transparency, training and development, change management, system compatibility, ROI analysis, data governance, and continuous monitoring are key measures to address AI challenges in tax and finance.

Real-world Examples of AI in Finance

JPMorgan Chase: With its COiN platform that uses AI, JPMorgan Chase assessed legal documents and pulled out essential data points and clauses. The investment banking leader has minimized the time lawyers need to spend on these tasks from 360,000 hours a year to a fraction of a second.

OneStream: Through its Sensible AI Services which provides big data analytics solutions, OneStream allows financial institutions to gain insights into future market trends and improve strategic decision-making.

Mastercard: With an AI-based system, Decision Intelligence, Mastercard analyzes transactions in real-time. The system evaluates the authenticity of a transaction and provides a more accurate fraud score to minimize false declines.

Also Read: Top 10 Technology Companies Embracing ESG Strategies

Final Thought

Embracing AI and analytics in tax and finance will help financial institutions drive efficiency, improve compliance, and enable data-driven decision-making. With AI technologies, organizations can well-position themselves to navigate the complexities of the financial landscape and achieve sustained growth. They can bring informed decisions to tax planning and finance management by predicting future trends and ensuring compliance.

Stay tuned to The Future Talk for other updates for AI in finance and tax.