This is the second part of the C-Suite series article on maximizing business ROI and driving innovation within an organization. CFOs are the frontrunners of any business, ensuring the company’s financial health and stability.

With today’s world rapidly shifting to digital, it is an exciting time for the world of finance to drive innovation. Technology, particularly Generative AI, is transforming the industry at a significant pace. For Chief Financial Officers (CFOs) or aiming to become one, Generative AI is a transformative technology to maximize ROI and drive financial success.

According to the IBM Institute for Business Value report, organizations that have already adopted AI have witnessed reduced sales forecast errors by 57%, minimized uncollectable balances by 43%, and cut monthly close cycle time by 33%.

If you as a CFO looking to maximize your ROI along with driving efficiency within the organization, embracing GenAI can be decisive. Let us delve into the fascinating world of Generative AI and understand how it can become your secret companion for yielding high ROI.

Also Read: Maximizing AI: The CEO’s Next Big Thing

Generative AI

Generative AI, a type of artificial intelligence (AI), designed to generate new content – text, images, audio, or even entire virtual environments. Unlike conventional AI which emphasizes existing data analysis to make predictions, Generative AI can produce novel outputs based on patterns it learns.

GenAI combines the intersection of two technological advances – one is large language models (LLMs) and another is machines with mammoth computing power. By using complex algorithms, like neural networks, this AI technology creates content that can mimic human creativity.

GenAI can be a finance executive’s assistant in drafting reports, making financial models, and even suggesting strategic decisions, all in a fraction of the time.

Also Read: AI in Financial Reporting and Auditing: A Comprehensive Overview

Strategic Integration of Generative AI in Financial Planning

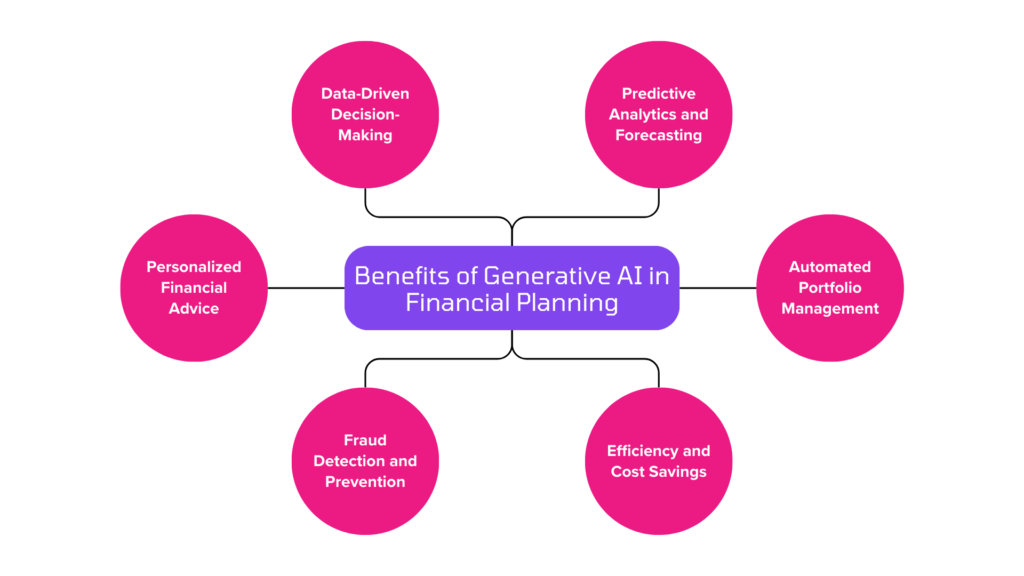

By harnessing the capabilities of Generative AI, financial institutions and CFOs can improve their decision-making processes, provide personalized advice, and optimize their overall planning strategies.

Traditionally, financial planning relied heavily on manual analysis and human expertise. The advent of GenAI has transformed this process, automating and enhancing various aspects of planning and decision-making.

According to Goldman Sachs, “Over the next 10 years, AI could increase productivity by 1.5% per year. And that could increase S&P 500 profits by 30% or more over the next decade.”

CFOs in the Age of Generative AI

Financial executives must embrace the intelligence of GenAI. They should leverage cutting-edge technologies to drive growth and innovation. Generative AI is a game-changer technology that can redefine the approach to financial management.

Let’s have a look at some key strategies a CFO can consider to leverage the capability of Generative AI to yield high ROI.

- Automate Routine Financial Tasks

Embracing Generative AI can help finance executives automate repetitive and time-consuming tasks, such as data entry, financial reporting, and reconciliation. Since this technology automates financial processes, it frees up teams to focus their time on higher-value activities, such as strategic planning and analysis.

- Enhance Decision-Making with Predictive Analytics

By leveraging Generative AI, you can assess large amounts of data and identify trends that might not be immediately apparent to human analysts. This predictive analytics can help you make more informed decisions and predict future financial challenges and opportunities.

- Optimize Cash Flow Management

Cash flow is the backbone of any organization. Using Generative AI can help CFOs optimize cash flow by anticipating cash inflows and outflows with greater accuracy. This enables them to manage working capital more effectively while ensuring that they have the necessary funds to meet their requirements.

- Improve Financial Planning and Analysis (FP&A)

Integrating Generative AI into your FP&A processes can provide you with in-depth insights into financial performance. You can further make more accurate budgets, predictions, and financial models. With GenAI, you can even identify potential risks and opportunities and adjust your strategies accordingly.

- Enhance Risk Management

One of the CFO’s critical aspects is risk management. Generative AI can help them identify and dodge risks more effectively by evaluating data from multiple sources and providing real-time insights. By implementing AI-powered risk assessment tools, CFOs can monitor and predict market conditions, meet regulatory changes, and other external factors that could impact their financial stability.

- Drive Innovation and Growth

Generative AI can help drive innovation within your organization. You can leverage AI to identify new business opportunities and streamline operations. As a CFO, you can even drive growth while creating a competitive advantage. Knowing your customers and identifying trends can help you with new product development and market expansion strategies.

- Enhance Fraud Detection and Prevention

For any organization, fraud prevention is a significant concern. By utilizing Generative AI, you can examine patterns and anomalies in financial transactions, helping you detect and prevent fraudulent activities. Integrating the right AI-enabled fraud detection systems will allow you to monitor transactions in real-time and flag suspicious activities.

Furthermore, CFOs can take some proactive steps to utilize GenAI which are as follows:

- Fundamental understanding of GenAI

- Collaboration with other functional leaders

- Upskilling or hiring next-gen talent

- Assessing the company’s tech needs

Factors Driving GenAI Adoption in Organizations

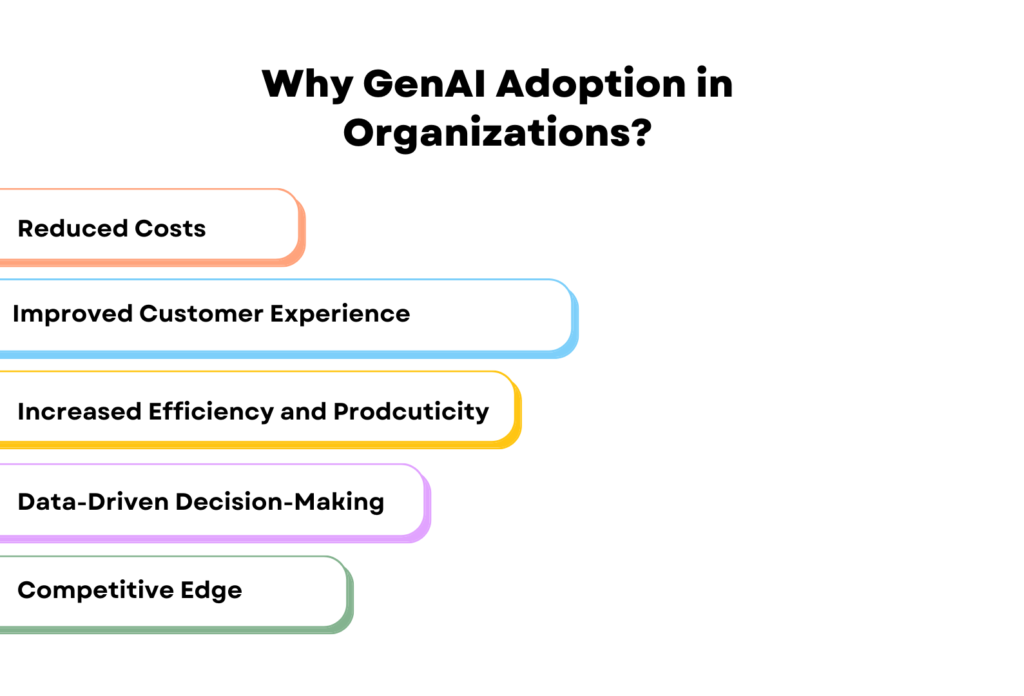

After analyzing various reports and surveys, we found that reduced costs, improved customer experience, and enhanced efficiency and productivity are some of the top concerns of companies planning to use GenAI.

Conclusion

Generative AI provides CFOs with unprecedented opportunities to yield high ROI. This AI technology gives them the ability to automate routine tasks, enhance decision-making, optimize cash flow, improve FP&A, and enhance risk management. CFOs must not only adopt GenAI but also integrate it into their strategic vision.

Stay tuned to The Future Talk for more such interesting topics. Comment your thoughts and join the conversation.